Multiples Analysis & Comparables for Vita Coco: Strategic Insights and Valuation Perspectives

Strategic Valuation Insights: Navigating Vita Coco's Market Potential

Introduction

Vita Coco has established itself as a leading brand within the coconut water category, a niche segment experiencing steady growth. However, as the competitive landscape evolves with major beverage giants expanding their product portfolios, it's crucial to evaluate Vita Coco's valuation using key financial multiples and compare its positioning against industry leaders such as The Coca-Cola Company, PepsiCo, Monster Beverage, Celsius Holdings Inc, and Keurig Dr Pepper.

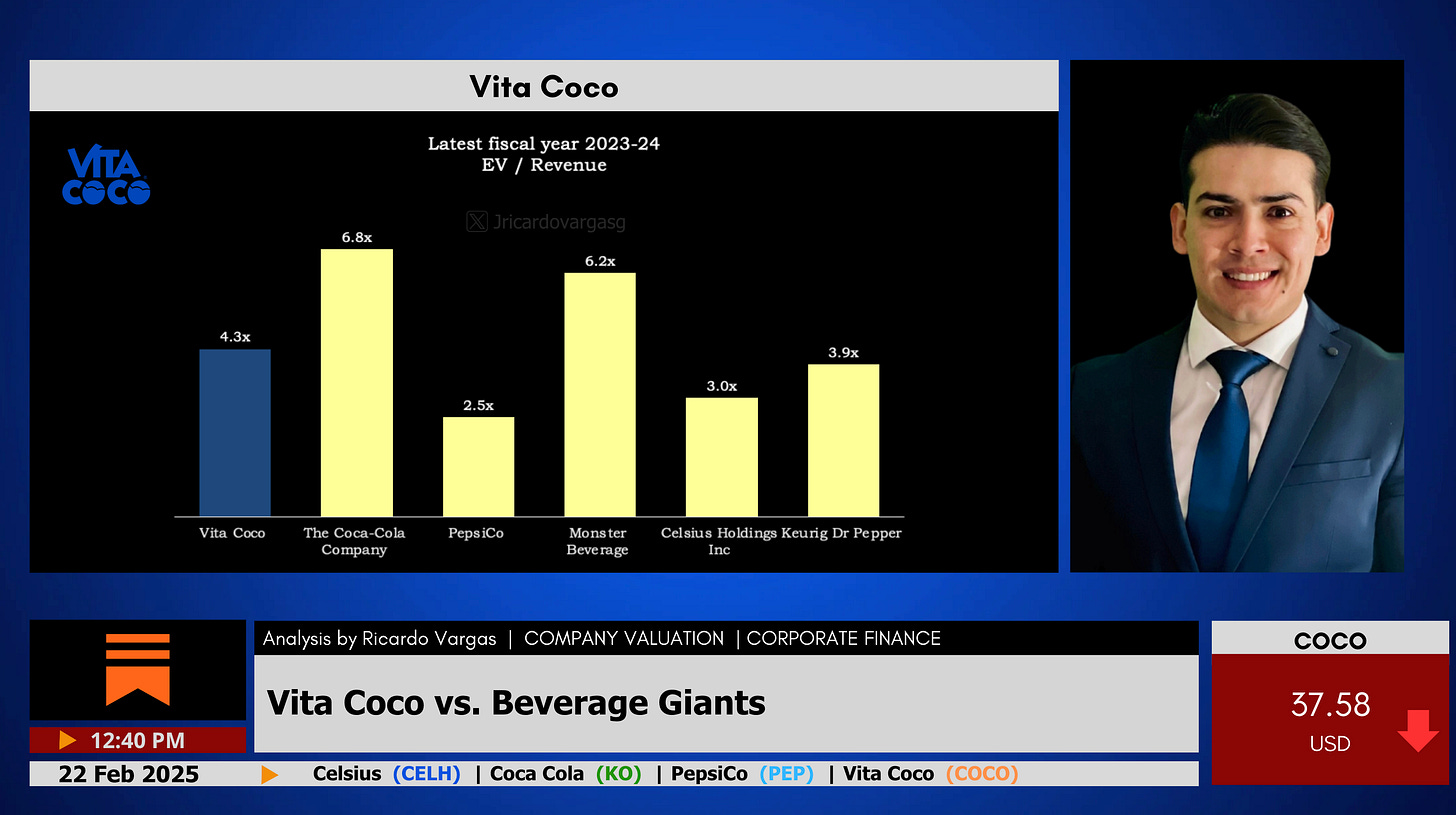

1. EV/Revenue Analysis

The EV/Revenue multiple provides a snapshot of how much investors are willing to pay for each dollar of sales, reflecting market sentiment on revenue growth potential.

Vita Coco trades at 4.3x, positioned lower compared to The Coca-Cola Company (6.8x) and Monster Beverage (6.2x), indicating a relatively conservative market expectation on its revenue growth trajectory.

Celsius Holdings Inc (3.0x) and PepsiCo (2.5x) are priced lower, possibly reflecting a different growth and market penetration phase.

This conservative multiple suggests that investors may perceive Vita Coco's growth potential as more mature compared to its peers, despite its brand strength and market leadership in the coconut water category.

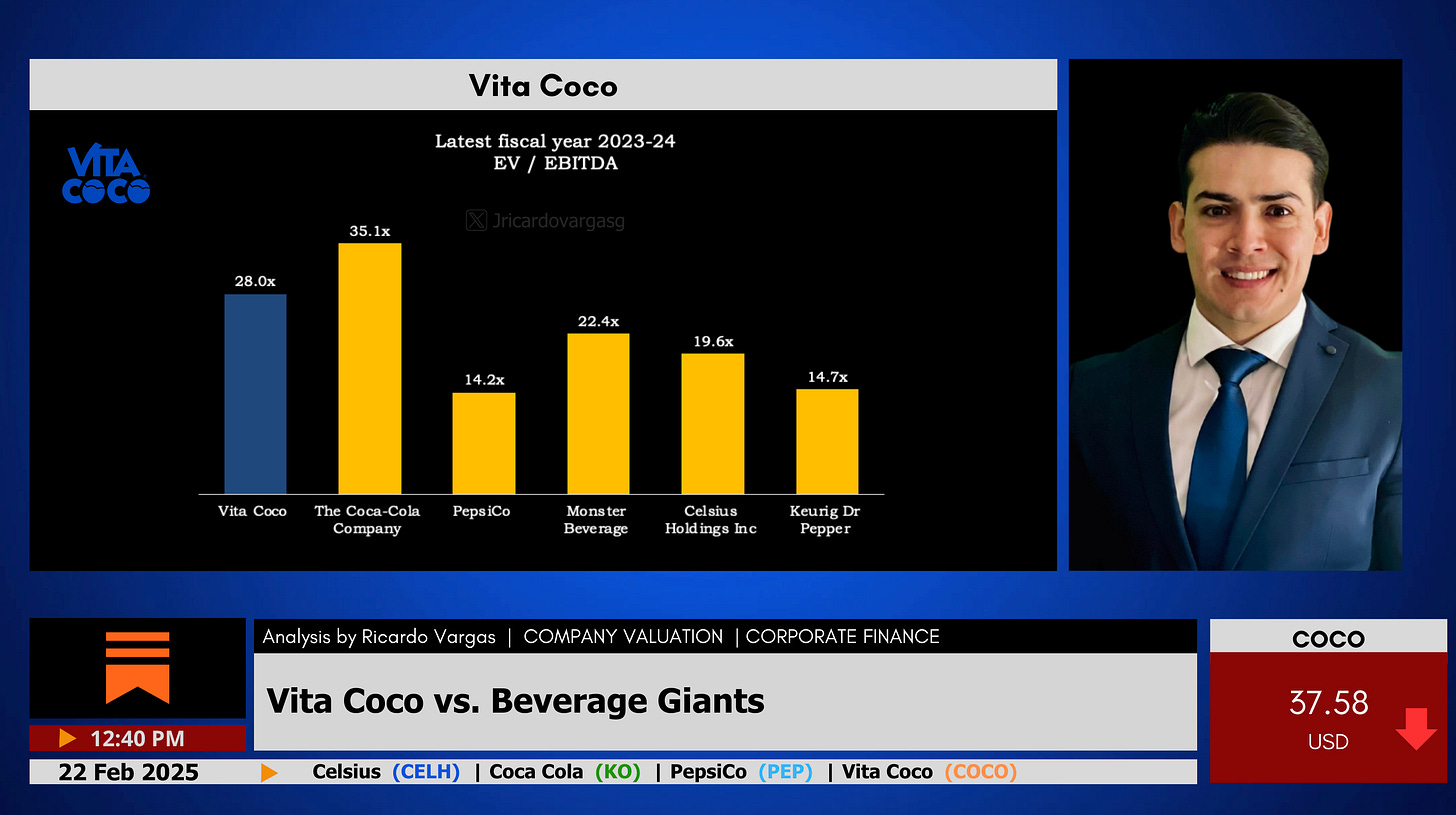

2. EV/EBITDA Analysis

EV/EBITDA multiples gauge the valuation relative to operational profitability, highlighting efficiency and margin stability.

Vita Coco's EV/EBITDA multiple is 28.0x, significantly higher than PepsiCo (14.2x) and Keurig Dr Pepper (14.7x).

The Coca-Cola Company (35.1x) commands the highest multiple, attributed to its global brand dominance and diversified product portfolio.

This premium valuation reflects investor confidence in Vita Coco’s operational efficiency and margin sustainability despite its smaller scale compared to its competitors.

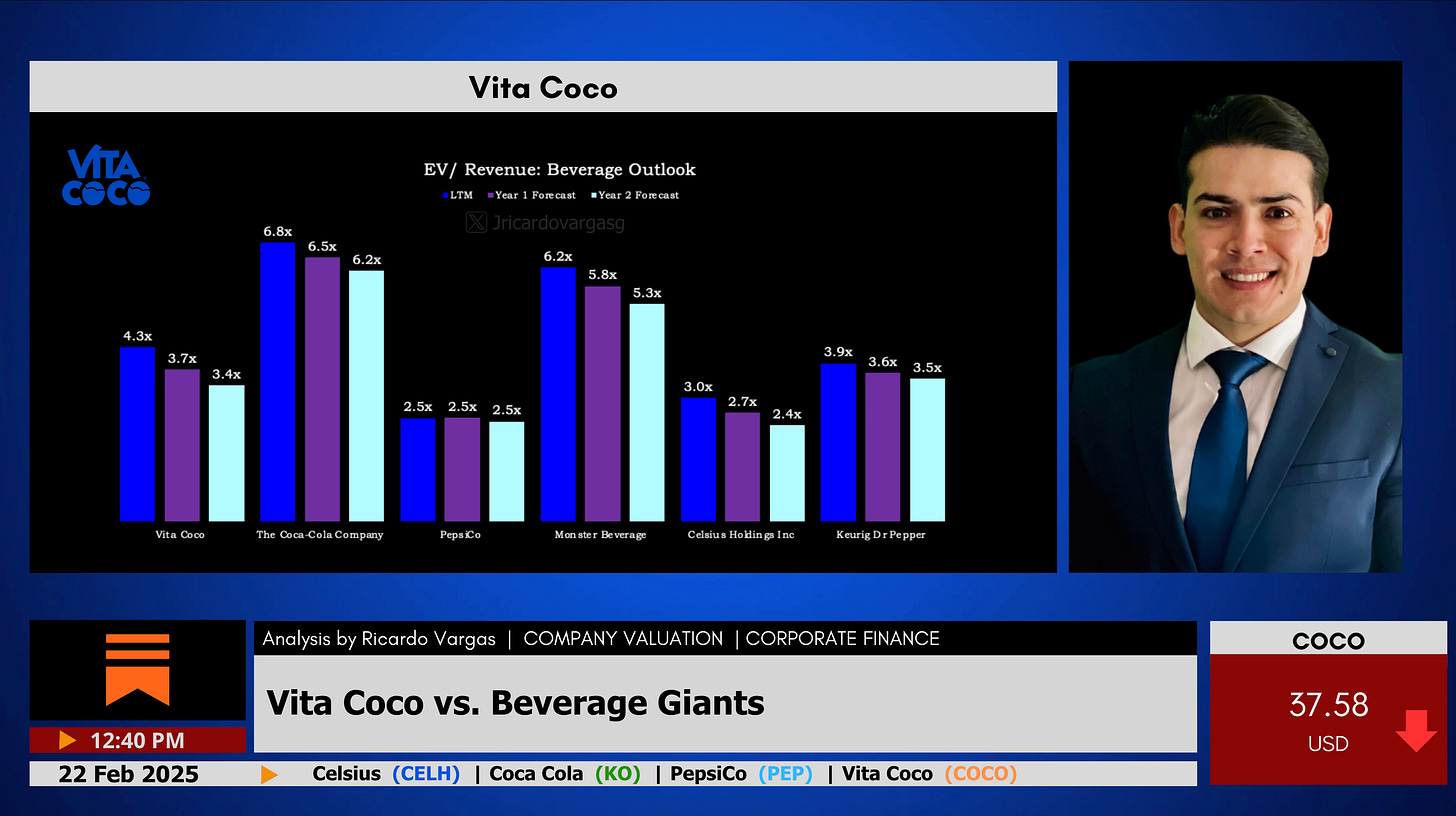

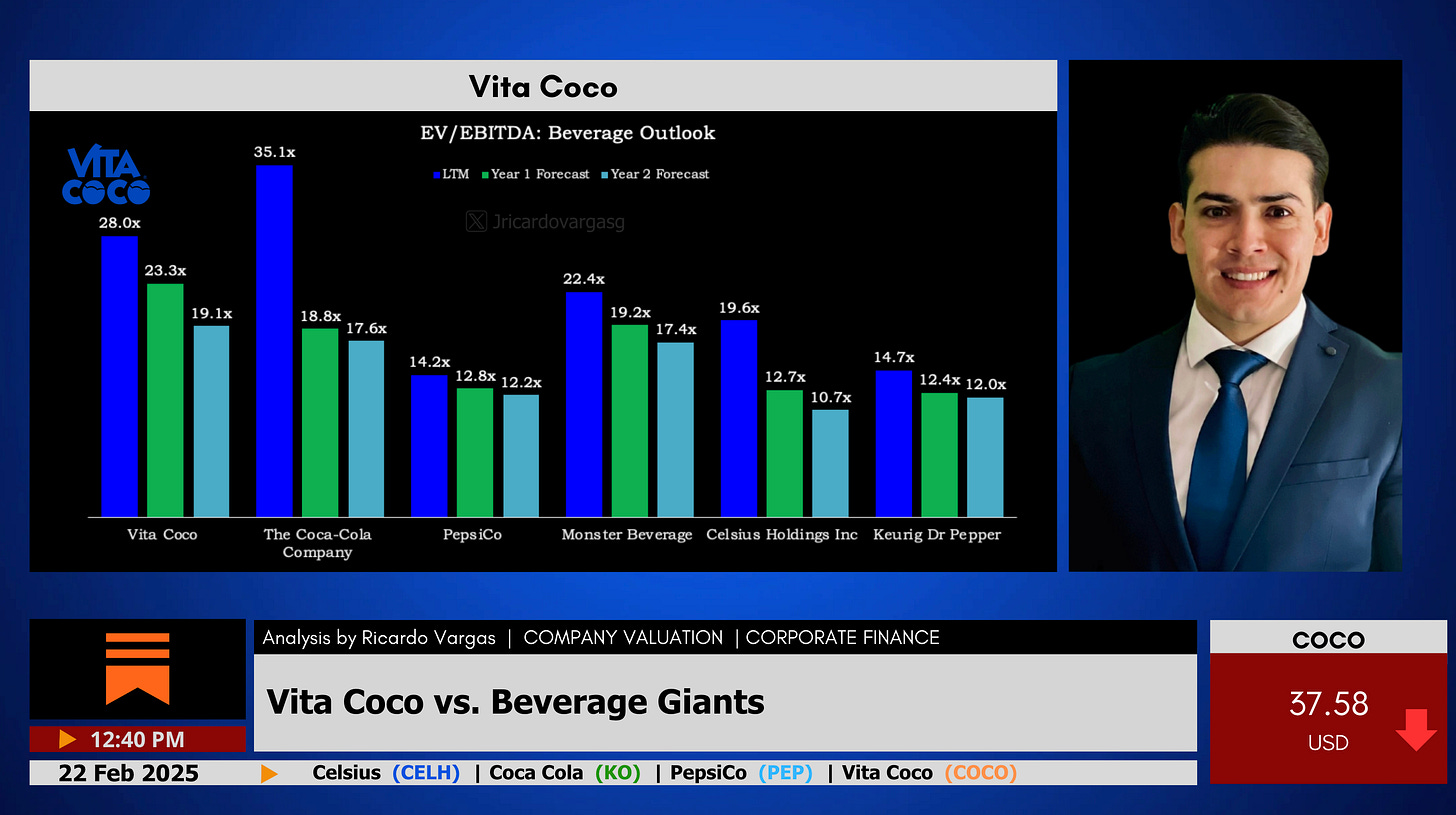

3. Forecasted Multiples Outlook

Forecasted multiples give a forward-looking perspective on growth and profitability expectations.

EV/Revenue Forecast indicates a slight decline for Vita Coco from 4.3x (LTM) to 3.4x (Year 2 Forecast), suggesting moderated growth expectations as the brand matures.

EV/EBITDA Forecast shows a similar trend, with a decline from 28.0x (LTM) to 23.3x (Year 2 Forecast), highlighting anticipated margin pressures or competitive dynamics impacting profitability.

This projected contraction in multiples could indicate market caution around the brand’s capacity to sustain its current growth and profitability levels amidst increasing competition.

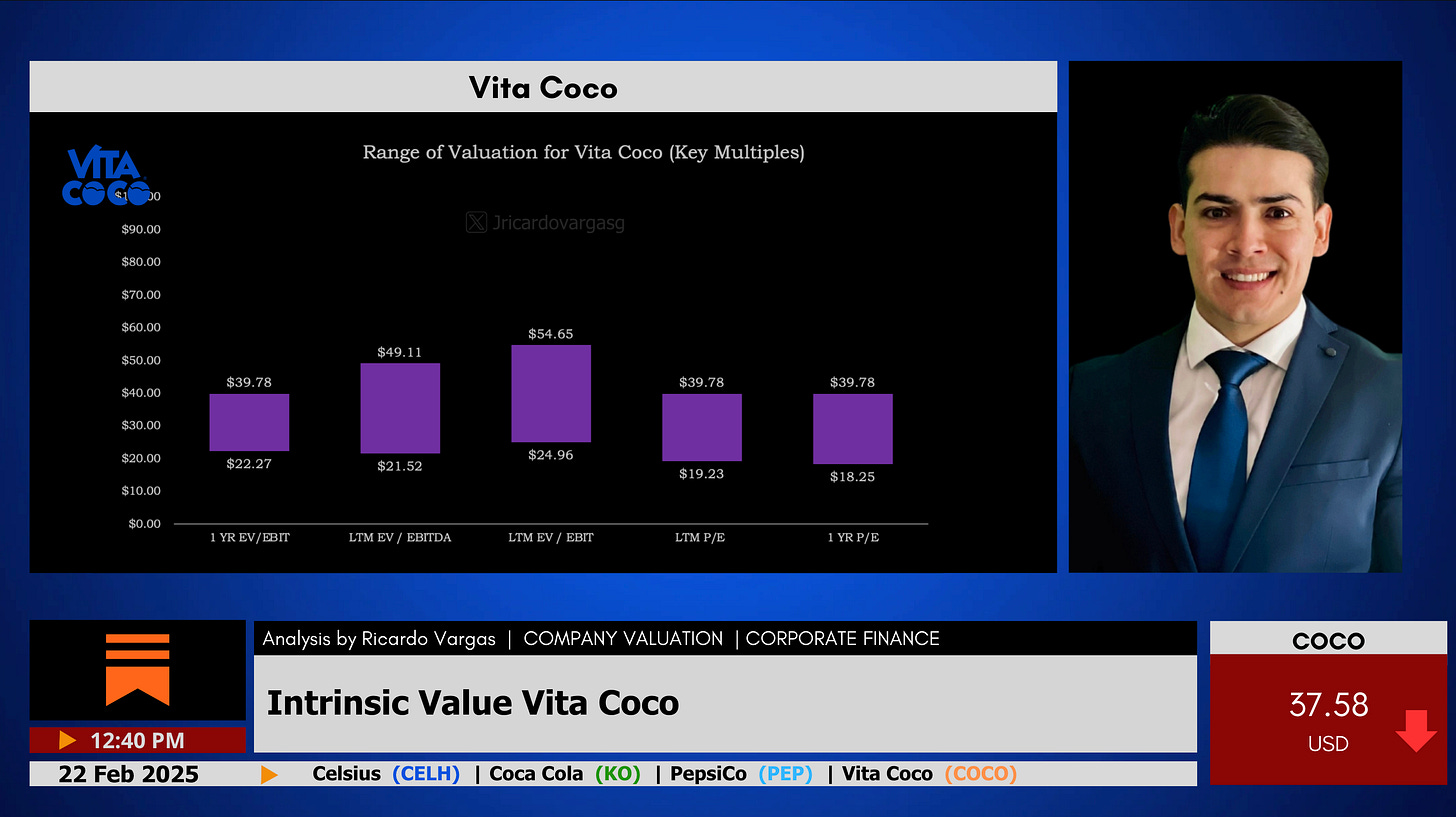

4. Intrinsic Value Assessment

Utilizing a range of valuation multiples, the intrinsic value of Vita Coco is estimated between $22.27 and $54.65 per share, with a mid-point of $47.80.

This valuation implies a potential upside from the current trading price of $37.58, contingent on the company’s ability to maintain growth momentum, optimize margins, and expand its international footprint.

The intrinsic value is anchored on conservative revenue growth estimates of 5%, reflecting a realistic trajectory given the brand's market positioning and category dynamics.

Strategic Perspective

From a strategic standpoint, Vita Coco's growth prospects hinge on its ability to innovate beyond its core product line, expand into international markets, and capitalize on the health and wellness trend. The company’s strategic pillars, including potential M&A in complementary categories, reinforce its competitive positioning. However, investor sentiment remains cautious, as evidenced by the conservative revenue multiples, reflecting the challenge of sustaining high growth rates amidst evolving consumer preferences and competitive pressures.

Disclaimer

This analysis is based on publicly available financial data and market projections. The valuation reflects my personal perspective and should not be construed as investment advice. Investors should conduct their own due diligence, considering their risk tolerance and investment objectives before making any financial decisions.

#CorporateFinance #Valuation #InvestmentAnalysis #BeverageIndustry #VitaCoco #StrategicInsights #MultiplesAnalysis #Comparables #IntrinsicValue #FinancialStrategy #RicardoVargas